Recently Decided Cases

DCW maintains a list of recently-decided court cases involving commercial letters of credit, standby LCs, demand guarantees, and other trade

This paper explores vessel risk based upon whether Group Ownership information is known or unknown for each vessel alongside identified compliance behavior.

Background

Financial institutions are increasingly expected to combat sanctions and financial crime compliance evasion by monitoring suspicious vessel behavior. These expectations are largely in response to the U.S. Department of the Treasury’s Office of Foreign Assets Control (U.S. OFAC) and the United Kingdom’s Office of Financial Sanctions Implementation (UK OFSI) advisories on shipping published in May and December 2020, respectively. These documents contained a number of recommendations for financial institutions to recognize and implement. While not previously expected of trade finance operations, a nuanced understanding of the maritime shipping industry has become a critical aspect of regulatory compliance, such as identifying commodities and trade corridors where transshipment and ship-to-ship (STS) transfers may occur.

The complexity of the shipping industry, however, has caused some anxiety amongst financial institutions as it requires a level of expertise that may not be reasonable for, or even available to, small or medium sized banks, whether seeking to bring such expertise in-house, or rely on sophisticated service providers.

Helpfully, recent guidance papers have been published to better assist the industry, but the authors considered that a global statistical review of vessel data could further benefit the community. This statistical review is intended to complement those guidance papers and further crystallize the compliance concerns arising from the shipping industry.

This review shares our findings related to the availability of vessel Group Ownership in relation to each vessel’s compliance behavior. Recommendations for financial institutions and insurance companies include adding at least one additional check during their risk-based approach. That check could be review of the ownership information of a particular vessel in light of its known compliance status, flag of country and ownership domicile. Put differently, banks should be able to, as a general matter, have a baseline calculation of risk for a given vessel so reasonable decisions may be made in light of the increased regulatory pressure regarding the maritime industry. Additionally, government regulators and port security officials should consider requiring Group Ownership information prior to port calls, and further down the line, establish a beneficial ownership registry to ensure additional transparency.

Methodology

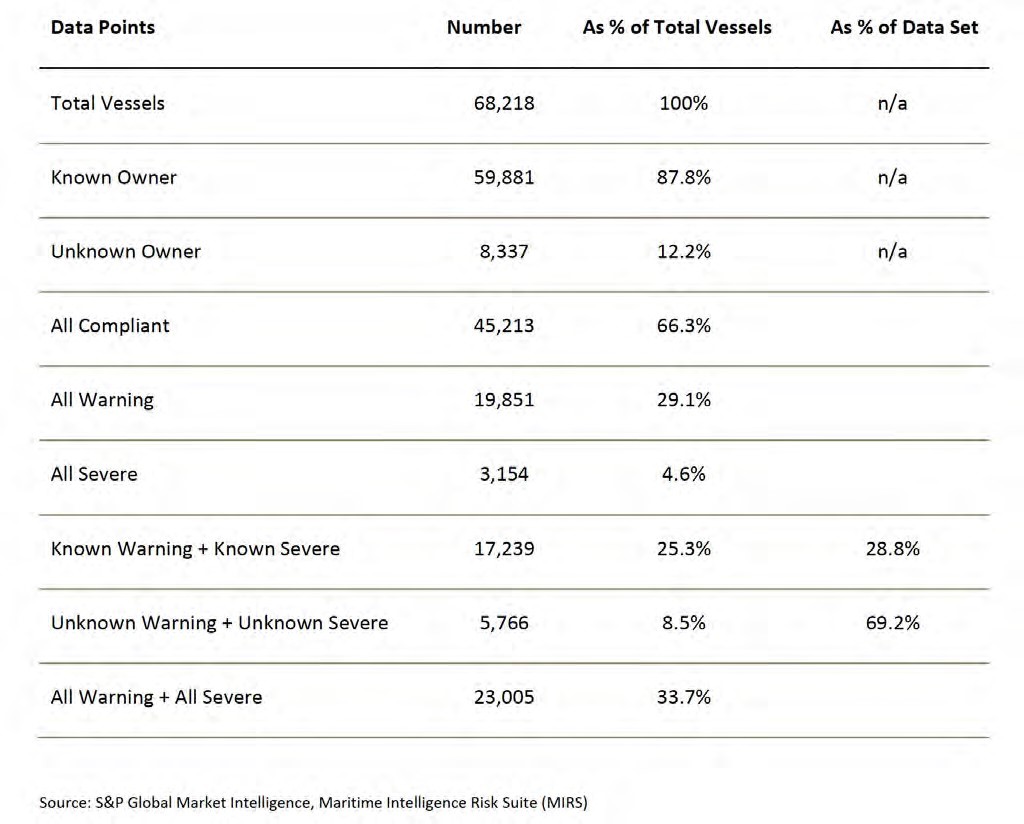

Data reviewed was provided by S&P Global Market Intelligence and is current as of March 2023. Authenticated data for 68,218 vessels were identified and sorted into various categories for analysis. The major delineation was whether Group Owner information was Known or Unknown regarding a particular vessel. The next distinguishing factor was a regulatory compliance assessment for each vessel of either (1) Compliant; (2) Warning; or (3) Severe. As stated in the Definitions section below, each compliance assessment carries a precise meaning.

Introduction

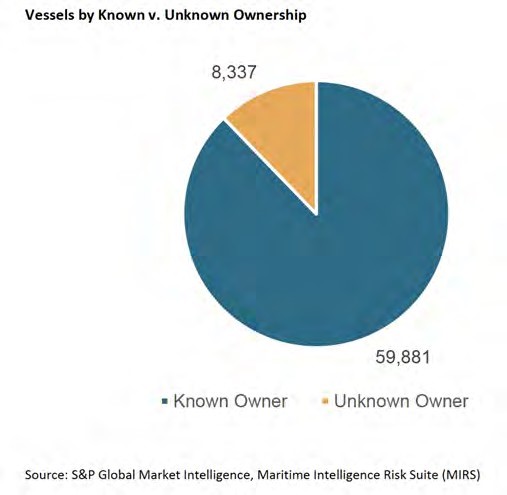

In order to properly review and assess whether having an Unknown Group Owner correlates to risky vessel behavior, we first need to define the world of vessels. As noted above, our dataset contained 68,218 vessels in service as of the writing of this paper. For the remainder of this review, Known Group Ownership is abbreviated as “Known” or “Known Owner”, and Unknown Group Ownership will be shortened to “Unknown” or “Unknown Owner.” For definitions of key terms used in this paper, please see the “Definitions” section below.

Breakdown of Vessels by Known Group Owner v. Unknown Group Owner

Of the 68,218 total vessels reviewed, 59,881 or 87.8% of the vessels had Known Owner information. Conversely, 8,337 or 12.2% of reviewed vessels had Unknown Owner information.

As noted in the Definitions, listing the Group Owner and Domicile is not a requirement to obtain an IMO number, but the absence of that information poses additional challenges for financial institutions and government regulators to find the Group Owner of a vessel.

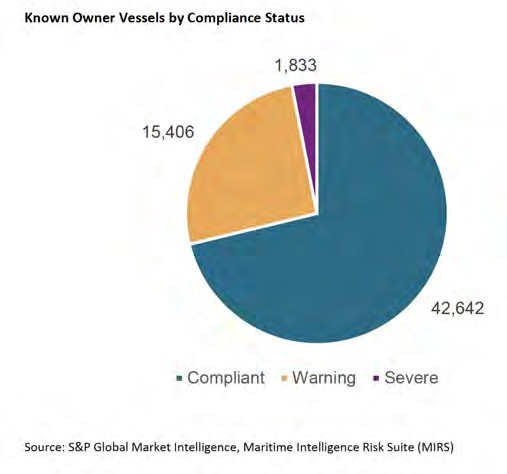

Known Group Ownership Vessels & their Compliance Assessments

Within the Known Owner subset of data, we further subdivided the data by their compliance status – “Compliant,” “Warning” and “Severe.” Of vessels with a Known Owner, 42,642 or 71.2% of such vessels had a Compliant status. It should be noted that “Compliant” for this paper means the vessel in question has met all of the regulatory requirements in regard to the latest maritime advisories published by OFAC and OFSI and also has not otherwise engaged in risky behavior that would designate it with a “Warning” or “Severe” status.

This value constitutes 65.5% of total vessels. 15,406 vessels or 25.7% of Known Ownership vessels had a Warning compliance score. The Known Owner Warning vessels represent 22.6% of total vessels. Lastly, 1,833 vessels with a Known Owner carried a Severe compliance score; this proportion was 3.1% of Known Owner vessels and 2.7% of total vessels.

As a general matter, vessels with Known Group Ownership are more likely than not to carry a compliant assessment status.

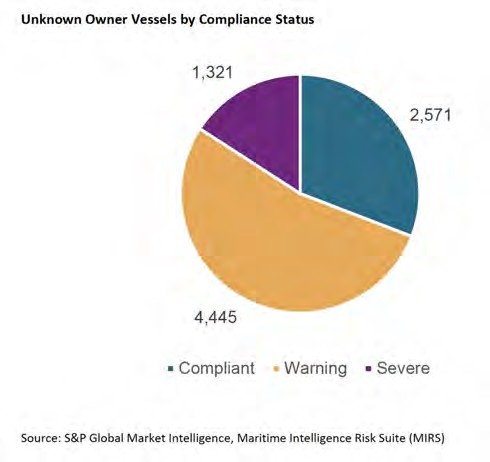

Vessels with Unknown Group Ownership & Compliance Assessments

As previously mentioned, there were 8,337 vessels with an Unknown Owner. Of these vessels, 2,571 or just 30.8% of this group had a Compliant regulatory status; this group also constitutes 3.8% of total vessels. Additionally, 4,445 vessels of Unknown Ownership were assessed with a Warning compliance score. The Unknown Ownership-Warning vessels were 53.3% of the Unknown Ownership vessels and 6.5% of total vessels. Finally, 1,321 vessels with Unknown Ownership were flagged as Severe. These vessels constituted 15.8% of Unknown Ownership vessels and 1.9% of total vessels.

Perhaps predictably, vessels lacking ownership information are more likely than their counterparts to either be assessed with Warning or Severe scores for compliance purposes. The authors also found it interesting that 3.8% of Total Vessels carry Compliant assessments while also lacking Known Ownership information. Indeed, as we will later show, a large percentage of vessels with Unknown Ownership have a ‘Warning’ or ‘Severe’ status.

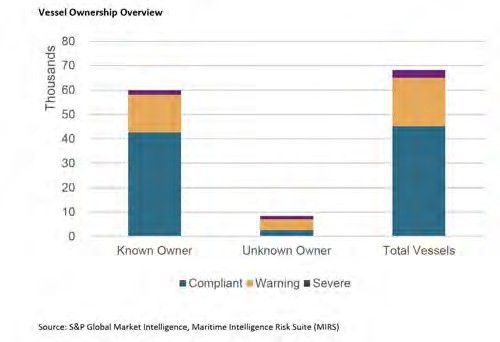

Comparing Known and Unknown Ownership to Total Vessels

In comparing the compliance status for vessels with a Known versus an Unknown Owner, the data is clear that Unknown Owner vessels occupy a larger share of the Warning and Severe assessments than those that are otherwise Compliant.

As nearly 70% of vessels with Unknown Owners carry either a Warning or Severe compliance assessment, financial institutions, insurance companies and port security agencies should exercise due diligence when met with Unknown Owner vessels.

Additional Data Breakout Information

The following numbers offer us a big-picture of the global state of vessel ownership, but for financial institutions, the data needs to be further combined to generate actionable intelligence.

The above table identifies all vessels with an Unknown Owner; 69.2% of them have either “Warning” or “Severe” as their compliance status. Stated more clearly as an actionable item for financial institutions, if the vessel transporting financed goods reveals “unknown” in the owner field following a public search of IMO information, then the vessel carries a greater than 69% chance of being higher risk and should be avoided.

Additionally, the authors of the paper, being familiar with the shipping industry, were surprised at the large number of vessels (8,337, 12.2% of total vessels) with Unknown Ownership. Before digging into the data, one author opined that the number would be roughly 5% to 8%.

What do Flags of Convenience Tell Us About a Vessel?

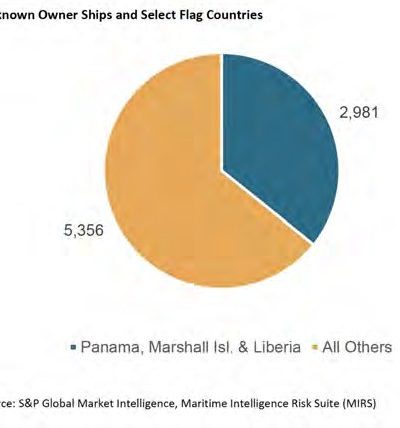

This dataset involves a case study regarding Flag of Convenience (FoC) countries and the relationship between ownership information and compliance statuses. Liberia, the Marshall Islands, and Panama were selected for this study, as they are three of the countries with the most vessels carrying “Warning” or “Severe” assessments. Of the 8,337 vessels with an Unknown Owner, 2,981 or 35.8% are flagged in Liberia, the Marshall Islands or Panama.

As the chart at left illustrates, the three selected countries for this case study carry more than a third of the globe’s flagged vessels without Known Ownership. The other 5,356 vessels with Unknown Owners are distributed across other countries.

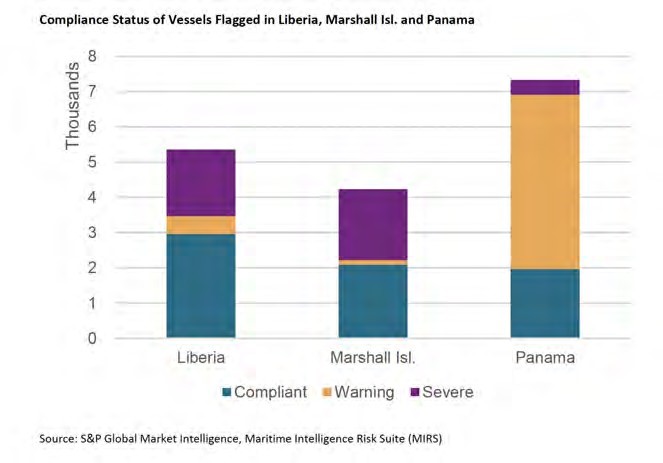

The bar graph at right displays the compliance status of all vessels, both with Known and Unknown Owner information. To no one’s surprise, all three of these countries have an unusually large number of vessels with a “Warning” or “Severe” status.

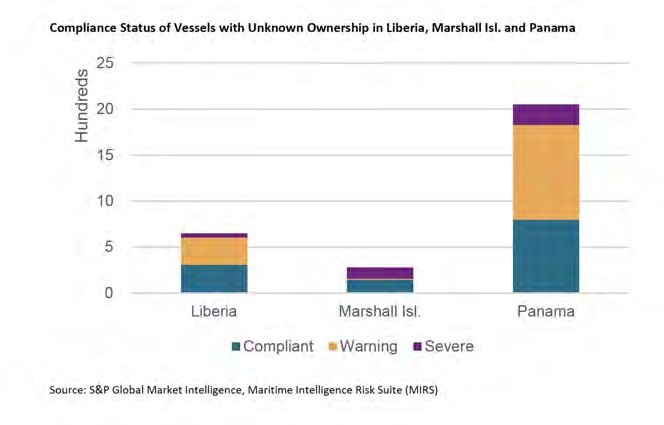

Further describing the risks associated with an Unknown Owner, this next chart shows the three countries broken down by compliance status, but only the dataset with Unknown Owners.

Since mid-2020, the U.S. OFAC and U.K. OFSI issued guidelines alerting financial institutions to monitor vessels carrying financed goods for possible sanctions violations, and the industry consensus has been that the flag of a vessel is not by itself an indicator of any illicit activity.

In fact, some industry professionals have disregarded flags within their compliance assessments. Based on our dataset of the top three countries in terms of vessels registered, those vessels with an Unknown Owner had rates of “Warning” or “Severe” compliance status between 47.8% (the Marshall Isl.) and 61.2% (Panama).

Based upon the data and analysis presented here, it is a fair judgment that a vessel’s flag is no longer dependent on additional warning signs or risky behaviors, and may now be considered as an indicator of risk when coupled with an “Unknown Owner” listing.

Asia Pacific as a Special Case for Known Owner Vessels Flagged in Panama

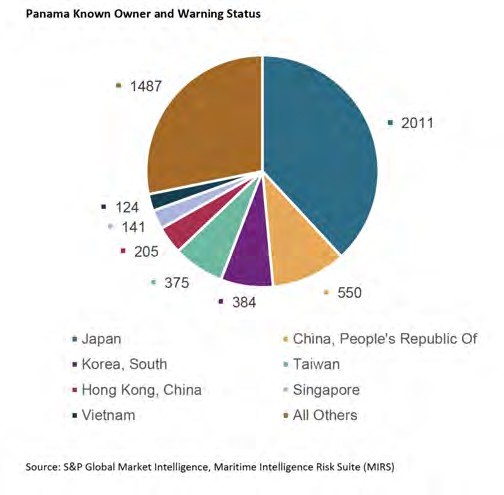

In reviewing the data, the authors observed an anomaly regarding a considerable number of vessels flagged in Panama with a Known Owner, while interestingly carrying a “Warning” compliance status. Specific to Panama, there are 5,277 vessels with a Known Owner irrespective of Compliance status. Of this subset, 3,912 or 74% of vessels have Known Owners and a “Warning” status (Panama Known Owner-Warning vessels). Another intriguing observation is that 3,790 vessels of the prior 3,912 subset, (97%) have a Group Owner Domiciled among seven select APAC Countries: Japan, People’s Republic of China, Taiwan, Hong Kong, Singapore, South Korea, and Vietnam while their listed “Registered Owner” for flag purposes is a subsidiary business registered in Panama. Stated differently, 3,790 of the 5,277 Panama flagged vessels with a Known Owner (72%) list their Group Ownership Domicile among those seven mentioned APAC Countries.

Further investigation into these “Warning” vessels with a Known Owner reveals a reasonable business justification: most of the countries where the Group Owner is domiciled have strict rules regarding vessel operation (e.g., a Japanese flagged vessel must be captained by a Japanese-citizen Captain, i.e. costlier than other Captains). Also, most of these vessels are “east – west” vessels, travelling from APAC to the Americas and back, often traversing the Panama Canal. In fact, 67% (2,524) of this 3,790-vessel subset are below the 120,000 DWT New Panamax size standard, and it should be noted that having the “Registered Owner” as a registered business in Panama allows for a small discount on the canal-use fees.

Since the Group Owners are all known and easily identifiable business entities, as are their Panama-registered subsidiaries, it is highly unlikely that these vessels are conducting illicit activities.

Nevertheless, this does not change the important highlight from the Flags of Convenience section above: Unknown Owner vessels registered in Panama, Liberia or the Marshall Islands have a high likelihood of carrying either a “Warning” or “Severe” compliance status, warranting enhanced due diligence.

Notably, of the total number of Known Owner vessels with a “Warning” status, 15,406, those flagged in Panama (Panama Known Owner-Warning) account for 3,912 of those vessels, i.e. about 25% of that vessel category.

U.S. Port Case Study

Additionally, vessels with unknown ownership visiting U.S. ports pose a significant challenge for policy makers. Data reviewed for this paper reveals that close to 500 individual vessels made over 800 unique U.S. port visits in 2022 roughly equaling 2 visits per day. A number of these vessels visiting U.S. ports with an unknown owner status have subsequently visited Russian ports in 2023.

Last year, U.S. Customs and Border Protection (CBP) made approximately 21,000 seizures of goods for intellectual property rights violations and over 46,000 total goods seizures. Given that over 80% of imported products reach the U.S. by sea, the data would suggest that a clearer understanding of who owns those vessels could prove beneficial to law enforcement.

Moreover, global estimates put product counterfeiting at $1 trillion per year and illegal fishing, mining and logging at another $150 billion annually. It is likely that most of those illegal shipments are by sea which raises the question of whether, as a way to distance individuals from illegal activity, ships with unknown ownership are being used to transport these goods. The questions raised by unknown vessel ownership require more data analysis including CBP information on ships that delivered goods to the U.S. which were later interdicted. By linking interdicted goods with the vessel – and thus to the vessel’s owners – patterns may emerge which can help curtail growing illegal trade activity.

Policy Recommendations

Based upon the data presented in this paper, the policy recommendations offered here will improve transparency in the maritime shipping industry.

1. Vessel Ownership Listing as a Risk Assessment Tool

When reviewing a vessel for a proposed financial transaction, discovering that the vessel has Unknown Ownership indicates that there is a 69.2% chance that the vessel carries a Warning or Severe compliance status. Further, consider that if the vessel is registered under one of the three highlighted Flag of Convenience countries in this review, some enhanced due diligence ought to be exercised. All financial institutions should at least consider vessel ownership as a primary risk indicator. Those with available resources should conduct further due diligence on those vessels without known owners.

2. The U.N. IMO Should Begin Requiring Group Owner Information

Based upon the strength of the data presented, the riskiest group of vessels are those without a listed Group Owner. As 69.2% of these have a “Warning” or “Severe” compliance status, requiring this information when applying for an IMO number will improve transparency.

3. A Beneficial Ownership Registry for Vessels Should be Established

Listing the Group Owner for all vessels is a fine start but finding the actual individual(s) who ultimately own and profit from a vessel will ensure additional transparency. The IMO registry is the obvious candidate to manage such a list as they already possess the vessel information; thus, hosting this additional data makes sense.

4. U.S. Customs Requiring Beneficial Ownership for all Vessels

As noted in 2022, there were approximately 2 port calls per day from vessels with an Unknown Owner in the U.S.; this presents a security risk as well as an opportunity for additional financial crimes to occur. Those could include carrying counterfeit goods and certainly counterfeit pharmaceuticals. The U.S. Customs and Border Patrol should require that all vessels entering U.S. ports submit at least Group Ownership information, a business identification number, such as a Legal Entity Identifier (LEI) and, once a registry is established, the beneficial owner.

5. Vessel Flag now an Independent Risk Factor

Prior to this review, vessel flags and any concerns with Flags of Convenience were considered secondary risk indicators, requiring other primary indicators of suspicious vessel behavior such as AIS outage to merit enhanced due diligence. The data presented here, however, reveals a clear correlation between Unknown Ownership and vessel flags such that the flag should now be considered a primary and independent risk factor when associated with an “Unknown Owner” listing.

General Definitions

The following terms occur frequently within the following review. To assist the reader, definitions are provided for convenience and clarity before engaging the statistical analysis.

Vessels. Vessels hereinafter defined as maritime sea crafts with cargo carrying capacity, including tankers, bulkers, container ships, general cargo ships, and Roll-On-Roll-Off Sea craft.

Total Vessels. Means the 68,218 vessels identified and reviewed for this paper.

Compliance Assessments. The following compliance categories were assigned to each vessel and are defined here. It should be noted that these terms are generated by the vessel’s behavior and assigned by S&P Global Market Intelligence. They are not official designations by OFAC, OFSI, the UN, or any government entity, although vessels appearing on various sanctions lists are included in the “Severe” assessment.

Known Ownership. A vessel with a “Known Owner” means the Group Owner opts to list the business name and country of domicile in the IMO records. Listing the Group Owner’s name is not a requirement to obtain an IMO number.

Unknown Ownership. A vessel with an “Unknown Owner” means the Group Owner of the vessel opts not to list or identify the business name and country of domicile in the IMO records when registering. Listing the Group Owner’s name is not a requirement to obtain an IMO number.

Beneficial Owner: The individual(s) that truly owns, controls and economically benefits from a company or legal entity is known as the beneficial owner. It should be noted that there is no universally accepted definition of “Beneficial Owner”; the meaning of the term varies across governments, regulatory bodies and industries.

Group Owner. The Group Owner is the company that is the ultimate owner of the vessel. This is the top-level owner, although they might establish a subsidiary business in another country for tax or vessel operation purposes, listed as the “Registered Owner.”

Group Owner Domicile. This is where the Ultimate or Beneficial Owner’s business is registered.

Note that this may or may not be the country under which the vessel is flagged.

Registered Owner. To register a vessel in any country, a registered business is required, and the “in-country” business is the “Registered Owner” for flagging purposes. This is a lower level of ownership and is often done to register a vessel in a country other than where the Group Owner is domiciled. For example, a vessel’s Group Owner might be a Greek business, but for tax and vessel operation purposes, the Registered Owner is a subsidiary established in the Marshall Islands.

Flagged (or Flag State). Means the country under which a vessel is registered. Each country has developed their own rules and regulations that a vessel must meet to carry that country’s flag. As noted in other relevant definitions, a vessel may be flagged in a country where the Group Owner is not registered.

Flag of Convenience (FoC). International law requires that every vessel is registered in a country, called its flag state. Certain countries provide so-called “open registries” in which companies not based in that jurisdiction may register a ship there so as to avoid financial charges or restrictive regulations in the Group Owner’s country. These instances are referred to as “flags of convenience.”

Dead Weight Tonnage (DWT). Also known as deadweight or tons deadweight, is a measure of a vessels weight carrying capacity. This does not include the actual weight of the vessel itself, but does include all cargo, fuel, fresh water, ballast water, provisions, passengers and crew.

New Panamax (Neo-Panamax) Standard. A “Standard” size in shipping means that the vessel can traverse waterways or ports because their DWT falls within the allowed range. With the opening of the new Third Locks of the Panama Canal, vessels up to a max of 120,000 DWT may traverse the Panama Canal. Prior to the new locks, the original Panama Canal locks allowed for a max of 52,500 DWT, and was known as “Panamax.”

Automatic Identification System (AIS). The AIS is an automatic tracking system that allows the transmission of a ship’s position. The 2002 IMO Convention for the Safety of Life at Sea Agreement mandates the use of an AIS transceiver in vessels larger than 300 gross tonnage engaging in international voyages.

Copyright © 2023 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved.

Reprinted by permission.

These materials have been prepared solely for information purposes based upon information generally available to the public and from sources believed to be reliable. For a sharable report and full copyright statement, click here.

Gain full access to analysis, cases, eBooks and more with a DCW Free Trial