DCW Monthly: February 2026

This month’s edition emphasizes how seemingly small drafting choices and operational decisions can lead to substantial legal and compliance

The September 2025 bankruptcy filing of First Brands has thrust supply chain finance into the industry spotlight again. Supply chain specialist Tat Yeen Yap explains how certain forms of SCF techniques work and addresses whether they can give rise to opaque accounting and hidden financial debt.

Supply chain finance (SCF) has come under the spotlight in the wake of the bankruptcy of US-headquartered First Brands Group, LLC in September 2025. The declaration of its Chief Restructuring Officer stated that the group’s debt under “unsecured supply chain financing” and “accounts receivable factoring” amounted to more than USD 3 billion (the Declaration).[[1]]

First Brands had other debt that included funded debt obligations and “off balance sheet financing”. Combined with SCF, it owed financial institutions in excess of $11 billion. The collapse of First Brands has sparked accusations of opacity and hidden financial debt, including in the use of SCF.

The purpose of this article is to explain how certain SCF techniques work and to address whether they give rise to opaque accounting or hidden debt. Whilst reference is made to certain public information on First Brands, this article does not purport to provide any opinion on their use of SCF.

Founded in 2013, First Brands is an automotive aftermarket parts supplier that had grown quickly via acquisitions of other businesses to assemble a portfolio of some 25 brands across key product categories such as brakes, filters, wipers, lights, pumps, and towing solutions.

First Brands’ customer base included large automotive retailers (such as Advance Auto Parts, AutoZone, O’Reilly’s and NAPA Auto Parts), wholesale distributors (such as United Auto Supply, Federated Auto Parts and Fischer Auto Parts) and commercial retailers (such as Walmart, Costco and Amazon).

Annual sales of First Brands was $5 billion in 2024, with earnings before interest, tax, depreciation and amortisation (EBITDA) of $1.133 billion. The Declaration mentions annual debt servicing costs of $900 million, suggesting a rather high debt servicing to EBITDA ratio.

Based on the Declaration, First Brands used the following financing techniques that are considered within the ambit of Supply Chain Finance:[[2]]

I. “Accounts Receivable Factoring”, which comprised:

a. “Customer Factoring” – for undisclosed amounts.

b. “Third-Party Factoring” – declared accrued liability of $2.3 billion.

II. “Unsecured Supply Chain Finance” – for about $800 million.

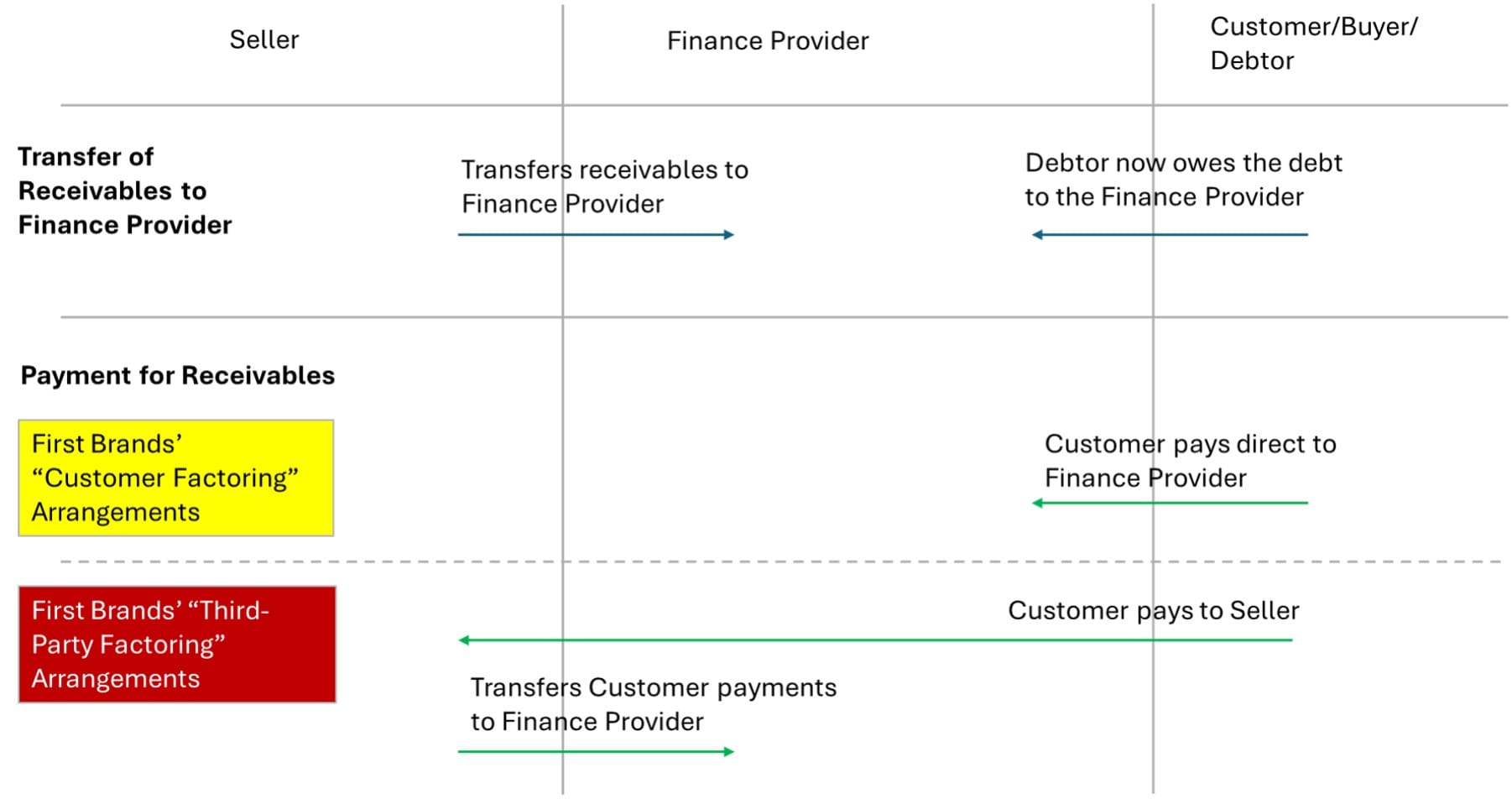

“Accounts Receivable Factoring” are explained as arrangements under which “the Company would sell accounts receivable generated from the sale of goods in exchange for near term payment on invoices with extended payment terms.” The Declaration distinguished between “Customer Factoring” and “Third-Party Factoring” – the differences between them are illustrated below and further elaborated hereafter.

The Declaration did not include a description of the term “Unsecured Supply Chain Finance”. However, it is likely to encompass Payables Finance arrangements that First Brands availed for its suppliers.

The Declaration provided the following description[[3]] for what it termed “Customer Factoring”:

“Under the Customer Factoring arrangements, [First Brands] entered into factoring arrangements with their large retail customers that had lengthy payment terms (up to 365 days). Under these arrangements, [First Brands] would sell receivables to financial institutions that partner with their customers in exchange for near-term payment, often within 30 days. When the receivables later become due, the customer may pay the receivable to the financial institution directly, instead of payment coming from [First Brands].”

The “Customer Factoring” arrangements as described are offered by the financial institution partners of First Brands’ customers, suggesting that they are Payables Finance programmes. These are also variously known in the market as “Reverse Factoring”, “Supplier Financing”, or simply “Supply Chain Finance”. Payables Finance are buyer-led programmes in which sellers in the buyer’s supply chain are able to access finance by means of Receivables Purchase”.[[4]]

In Payables Finance, financing is provided to the seller for up to 100% of the amount of the buyer’s payables (seller’s receivables) based on approved payables information provided by the buyer to the finance provider. The buyer commits to pay all such approved payables on the due dates, and on the due date of the payables, the finance provider applies the buyer’s payment to settle the advances it has made on the payables.

By onboarding to the Payables Finance programme of a buyer, the seller is able to increase its capacity to sell to the buyer and provide the credit terms requested by the buyer. The seller sells its receivables (the approved payables of the buyer) to the finance provider, removing the commercial debt from its books, reducing its Days Sales Outstanding and shortening its cash conversion cycle. This is possible because financing to the seller under a Payables Finance programme is typically on a without recourse basis, which means the seller has no repayment obligation.

It is likely that for the attributes of Payables Finance as aforementioned, First Brands’ use of Payables Finance (which the Declaration called “Customer Factoring”) did not contribute to the declared debt to financial institutions – it is treated as off-balance sheet financing and not financial debt.[[5]]

In the Declaration, “Third-Party Factoring”[[6]] is thus described:

“Under the Third-Party Factoring arrangements, [First Brands] would sell a receivable to an unaffiliated third-party factor (i.e., a factor that had not partnered with a customer of [First Brands]). The factor would pay [First Brands] for the receivable in the near-term, sometimes within seven (7) days, in exchange for a payment approximately 105 days later. Unlike the Customer Factoring arrangements, when a payment is often made by the customer directly to the customer’s financial institution partner, the payment is required to be made directly by [First Brands] to the Third-Party Factor, rather than the customer that owes the receivable.”

Unlike “Customer Factoring” which is buyer-arranged financing (Payables Finance), First Brands’ “Third-Party Factoring” arrangements point to factoring that First Brands enters into with its own financial institution partners, i.e. it is a seller-led financing arrangement.

The term “Factoring” was likely used in a general sense to describe financial institution advances to it for the group’s trade receivables. Factoring is a form of Receivables Purchase, typically at an advance ratio of less than 100% of the value of the eligible receivables. The advance ratio is set by considering the rate of historical dilution – the reduction in the value of receivables collected due to credit notes and other deductions.

Factoring or Receivables Purchase may be on a with or without recourse basis to the seller. When it is with recourse, the seller bears the risk of uncollectable receivables and may be required to repurchase from the finance provider uncollectible receivables. When it is without recourse, the seller has no repurchase or repayment obligation.

In factoring, it is typical for the finance provider to perform collection on its purchased receivables from the buyers (account debtors).[[7]] However, in Receivables Purchase arrangements, it is also possible that the financial institution appoints the seller as its collection agent.

The Declaration informs that payments by the account debtors for purchased receivables are made by First Brands to the financial institution. Such an arrangement is reflected in the text of the Receivables Purchase Agreement (RPA) submitted as an Exhibit in a court filing by Raistone Capital, LLC, one of First Brands’ finance providers:[[8]]

“Purchaser appoints Seller as its servicer and agent (in such capacity, the “Servicer”) for the administration and servicing of all Purchased Receivables, and Seller hereby accepts such appointment.

Purchaser may replace the Servicer in its absolute discretion upon written notice to the Servicer.

In the event that any Collections are received by Seller or Servicer, Seller and Servicer covenant and agree to pay to Purchaser … all amounts received as Collections on the Purchased Receivables within three (3) Business Days of receipt thereof.”

The RPA states that all proceeds from the Purchased Receivables were to be deposited into a Collection Account under the finance provider’s control, or, with the finance provider’s consent, into an account operated by First Brands. Any collections received by First Brands were to be transferred promptly (within three business days) to the finance provider. Pending such transfer, the sellers were obligated to hold those funds in trust, segregated from their own property and treated as the finance provider’s exclusive property.

The RPA stated that the Receivables Purchase is treated as a ‘true sale’, with the receivables becoming the property of the finance provider and removed from being that of the seller:

“It is the intention of the parties hereto that the sales, transfers and conveyances contemplated by this Agreement shall constitute an absolute sale of the Purchased Receivables, and the Related Security and Collections with respect thereto, from Seller to Purchaser and that the Purchased Receivables, and the Related Security and Collections with respect thereto, shall not be part of Seller's estate or otherwise be considered property of Seller in the event of the bankruptcy, receivership, insolvency, liquidation, conservatorship or similar proceeding relating to Seller or any of its property.” (Section 1(d))

Finally, concerning recourse, the Receivables Purchase arrangement is on a non-recourse basis to the seller, save for occurrence of typical recourse events:

“If any of the following events (“Events of Repurchase”) occurs and is continuing: (i.) any representation or warranty by Seller hereunder with respect to any of the Purchased Receivables is incorrect when made; or (ii.) a Dilution or Dispute occurs with respect to any Purchased Receivable, then: … Seller shall, at the time … repurchase, on Purchaser’s demand, any or all of such Purchased Receivables then outstanding affected by such Event of Repurchase.” (Section 5(a))

By entering into a factoring or Receivables Purchase arrangement as represented by the terms of the RPA shown, the seller is able to unlock cash tied to its trade receivables before they are due, removing them from its books and thus shortening its Days Sales Outstanding and cash conversion cycle. The characteristics of such financing differ from those of loans, which is a debt owed by the borrower to the lender.

Based on the terms of Receivables Purchase in this example:

The Declaration lists an amount of some $800 million under “Unsecured Supply Chain Finance” owed to financial institutions. This likely refers to Payables Finance arranged by First Brands for its suppliers, funded by First Brands’ financial institution partners (similar to the arrangements First Brands availed under “Customer Factoring” arranged by First Brands’ customers for their suppliers).

The Official Form 204 listing creditors who have the 30 largest unsecured claims on First Brands included 13 financiers who listed SCF exposures.[[9]]

Payables Finance has been explained under the header “Customer Factoring” above. If the financing under the buyer-arranged programmes is provided to the suppliers by way of Receivables Purchase, the financier becomes an unsecured creditor of the buyer for the purchased receivables.

The nature of the buyer’s debt within the credit period provided by the supplier typically remains as trade payables, i.e. as a commercial debt instead of a bank loan or financial debt, notwithstanding that a financial institution has purchased the debt. This is because the debt owed by the buyer arises from its ordinary purchases from its suppliers and its obligation is to pay the suppliers’ invoices when due.

see also: UPAS LCs as a Bridge to SCF

Off-balance sheet financing refers to arrangements that provide funding or liquidity without creating financial debt on the balance sheet of the party receiving or arranging the financing.

In a Receivables Purchase arrangement, the seller sells its receivables to a financial institution by way of assigning or transferring the receivables to the financial institution.

If the transfer qualifies for “derecognition” under applicable accounting standards, the transferred receivables and corresponding financing will not appear on the seller’s balance sheet – in such cases, the transaction is considered as off-balance sheet financing.

Under its International Financial Reporting Standards (IFRS), the International Accounting Standards Board (IASB) defines derecognition as “the removal of a previously recognised financial asset or financial liability from an entity’s statement of financial position”.[[10]] Financial assets and liabilities may be ‘derecognised’ if:

a. The entity transfers substantially all the risks and rewards of ownership;

b. The entity no longer controls the asset.

If substantially all the risks and rewards in relation to a sale of receivables are retained (e.g., via recourse obligations or deferred purchase price arrangements), derecognition is not permitted, and the financing is recognised as a loan liability.

The US Generally Accepted Accounting Principles (GAAP), issued by the Financial Accounting Standards Board (FASB), apply to First Brands’ financial reporting as First Brands is a US company.

Under US GAAP, the concept of derecognition is embodied in Accounting Standards Codification (ASC) 860, which provides for the “removal of financial assets from the balance sheet” and “accounting for transfers of financial assets”. A transfer of receivables is accounted for as a sale if:[[11]]

a. The assets are legally isolated from the transferor – the transferred receivables must be isolated from the transferor (seller), and put presumptively beyond the reach of the transferor and its creditors, even in bankruptcy.

b. The transferee has the right to pledge or exchange the assets – the purchaser (financier) must have the right to pledge or exchange the receivables without restrictions imposed by the seller.

c. The transferor does not maintain effective control over the transferred assets – when the seller does not exercise control over the receivables, and is neither entitled nor obligated to repurchase the receivables.

If any of these conditions under ASC 860 are not met for a Receivables Purchase transaction, it is treated as secured borrowing — meaning the receivables remain on the seller’s balance sheet with a corresponding debt obligation thereon. This distinction determines whether the transaction qualifies as off-balance sheet financing.

On Payables Finance, ASC 405-50 mandates disclosures of the supplier financing programs arranged by the buyer.[[12]] Auditors determine whether the buyer’s payable continues as a trade payable (commercial debt) or if it should appear as a financial debt (borrowing) – the key considerations being whether the buyer’s liability to the finance provider differs substantially from its original obligation to the supplier. Where it qualifies to remain a trade payable, financing to the supplier is not accounted for as borrowing by the buyer, i.e. the transaction qualifies as off-balance sheet financing.

Taken together, ASC 860 and ASC 405-50 establish the accounting perimeter of SCF from both the seller’s and the buyer’s perspectives, defining the requirements for off-balance sheet treatment for the financing arrangements.

The value of effectiveness, perfection, and priority in Receivables Purchase can be seen in an event of seller insolvency, in the test of whether a court would recharacterise the transaction from being a sale of receivables to that of a loan or secured financing.

Recharacterisation can arise due to (1) failure of the transaction to meet the accounting standards for derecognition, requiring the seller to then keep the receivables and financing on-balance sheet, and (2) deficiencies in the legal execution, resulting in the finance provider being treated as a secured creditor instead of as owner of the receivables. It invalidates off-balance sheet financing treatment, putting previously derecognised assets and liabilities on the balance sheet.

The financial statements of First Brands are not public. It can be surmised from the Declaration and other submissions relating to the Chapter 11 petition that $2.3 billion declared for “Accounts Receivable Factoring” (specifically, under what it calls “Third-Party Factoring”) was previously not reported on the balance sheet and therefore came as a surprise to creditors and observers.

As discussed in this article’s section on “Third-Party Factoring”, First Brands acted as collecting agent or servicer to the finance provider and was responsible for transferring all amounts received from its customers for purchased receivables to the finance provider (“third party factor”).

According to the Declaration:[[15]]

“Following diligence performed by the Company’s Advisors, the Debtors believe that an unpaid prepetition balance of approximately $2.3 billion has accrued with respect to the Third-Party Factoring arrangements as of the Petition Date. The Debtors’ factoring practices are subject to the Special Committee’s ongoing Investigation including

“(i) whether receivables had been turned over to third party factors upon receipt, and

“(ii) whether receivables may have been factored more than once.”

Regardless of accounting treatment (whether it is on- or off-balance sheet), unless the factoring or receivables purchase is with recourse and the buyer does not pay, there is no debt owed by the seller to the finance provider. And if the buyer has made payment, whether the factoring or receivables purchase is with recourse, no debt would be owed by the seller to the finance provider if the buyer’s payment has been made or transferred to the finance provider.

In First Brands’ bankruptcy filing, the reason the declaration of a $2.3 billion liability accrued for “Accounts Receivables Factoring” was made was because of the suspected irregularities (which are the subject of ongoing investigations) of:

The Declaration disclosed that First Brands had tried to restructure its debt in the months before its Chapter 11 filing. It then says:[[16]]

“Once those efforts did not materialize and as a result the Company Advisors’ discovery of the Third-Party Factoring irregularities, following which the Company’s liquidity became even more constrained, the Debtors immediately pivoted to a chapter 11 strategy.”

Regardless of whether the structure of the “Third-Party Factoring” arrangements were treated as off-balance sheet financing, or qualified to be, it appears that the declared debt of $2.3 billion related thereto was not supposed to exist. If the suspected irregularities are proven to be true, the debt attributed thereto would then have been hidden not because of opaqueness of off-balance sheet financing, but because they were illegitimately generated.

When used as intended, whether on the buy-side through Payables Finance or the sell-side through Receivables Purchase, SCF shortens the cash conversion cycle and enhances free cash flow. It delivers a step change improvement in working capital efficiency, releasing liquidity that can be deployed for growth, investment, or paying down existing debt.

SCF can keep heavily indebted companies going for some time, by providing much needed liquidity to stay afloat. However, if the company continues to accumulate more debt, a time may come that they cannot continue under the burden thereof, and SCF is not meant to deliver them from such debt.

Risks exist that SCF may be misused for its benefits. The more water-tight the SCF structure is, the lower the risk for financiers, as well as for the users’ shareholders, trade counterparties, and employees.

In the final analysis, the off-balance-sheet financing treatment of supply chain finance is not a weakness of disclosure, but a reflection of economic substance. When a receivable is sold under a legally effective, perfected, and non-recourse structure, the seller no longer bears the credit risk of that asset and so it is removed from its balance sheet. The financier, having purchased the receivable, rightfully assumes the risks and rewards of ownership; the buyer, for its part, continues to owe only its commercial payable.

Off-balance-sheet classification therefore does not make supply chain finance opaque. It delineates rather than distorts — separating asset sale from borrowing. Properly structured and executed, it achieves what accounting standards intend: the faithful representation of economic substance.

In its legitimate form, off-balance-sheet financing benefits all sides — buyers, sellers, financiers, and, ultimately, the economy that depends on the smooth flow of working capital. When structure, governance, and accounting principle align, supply chain finance performs its role with quiet precision: moving liquidity where it is needed most, without distortion of debt, and without detriment to transparency.

[[1]]: Declaration of Charles M. Moore in Support of Debtors’ Chapter 11 Petitions and First Day Motions, In re First Brands Group, LLC, et al., No. 25-90399 (CML) (Bankr. S.D. Tex. filed Sept. 2025) (https://restructuring.ra.kroll.com/firstbrands)

[[2]]: As defined by the Global Supply Chain Finance Forum (GSCFF), a joint initiative of ICC, BAFT, Euro Banking Association, FCI and ITFA established in 2014 to address the need to develop, publish and champion a set of commonly agreed standard market definitions for Supply Chain Finance and for SCF-related techniques. Website: https://supplychainfinanceforum.org/

[[3]]: p. 29-30 of the Declaration

[[4]]: See description of Payables Finance by the GSCFF: https://supplychainfinanceforum.org/techniques/payables-finance/index.html

[[5]]: According to a media report, on the day First Brands filed for chapter 11, restructuring advisers presented lenders with documents showing USD 1.6 billion of “customer programs factoring”. See: Alexander Gladstone and Mark Maurer, “BDO’s First Brands Audit Painted Healthy Picture Months Before Collapse,” Wall Street Journal, October 31, 2025, https://www.wsj.com/articles/bdos-first-brands-audit-painted-healthy-picture-months-before-collapse-2b8268c7

[[6]]: p. 30 of the Declaration

[[7]]: See description of Factoring by the GSCFF: https://supplychainfinanceforum.org/techniques/factoring/index.html

[[8]]: As seen in the Exhibit 4 showing the “Sixth Amended and Restated Receivables Purchase Agreement” (Section 4(a)) in Raistone Capital LLC’s Emergency Motion for the Appointment of an Examiner Pursuant to Section 1104(c), In re First Brands Group, LLC, No. 25-90399 (Bankr. D. Del. Oct. 8, 2025), ECF No. 307

[[9]]: First Brands Group Holdings, LLC, Official Form 204 — List of Creditors Who Have the 30 Largest Unsecured Claims (filed Sept. 28, 2025), https://d1e00ek4ebabms.cloudfront.net/production/uploaded-files/FBG%20Ch%2011%20petition-382b2adc-7041-4317-8723-fd9074d8d69c.pdf

[[10]]: International Accounting Standards Board (IASB), IFRS 9 Financial Instruments, Appendix A

[[11]]: Financial Accounting Standards Board (FASB), Accounting Standards Codification (ASC) 860 – Transfers and Servicing, Section 860-10-40-5

[[12]]: Financial Accounting Standards Board (FASB), Accounting Standards Codification (ASC) 405-50 – Supplier Finance Programs, Section 405-50-50

[[13]]: These include questions such as whether notice to debtor is required, who may/must serve any required notice and whether the transfer must be registered

[[14]]: For a fuller discussion of effectiveness, perfection and priority, see Tat Yeen Yap, “Comparing Receivables Purchase with Documentary Credit Financing”, Nov/Dec 2019 DCW 26, at: https://www.doccredit.world/receivables-purchase-dc-financing/

[[15]]: p.30 of the Declaration. “Debtors” as used in the Declaration refer to First Brands. According to a subsequent court filing by First Brands against its former CEO and related entities, invoice amounts submitted for financing were also inflated. First Brands Group, LLC v. Patrick James et al., Adv. Proc. No. 25-03803, U.S. Bankruptcy Court, Southern District of Texas (Houston Div.), Document 17 (3 Nov 2025), https://assets.bwbx.io/documents/users/iqjWHBFdfxIU/rW0IW_F6VoJY/v0

[[16]]: p. 33 of the Declaration

Gain full access to analysis, cases, eBooks and more with a DCW Free Trial